2023 Credit Card Debt Statistics

Americans have an absolute mountain of credit card debt — $1.031 trillion, to be exact.

This credit card debt statistics page tracks Americans’ credit card use each month. We update this page regularly, looking at how much debt people have, how often they carry a balance month to month, how often they pay their credit card bills late and more.

On this page

- How much credit card debt do Americans have?

- Which states’ residents have the most credit card debt?

- What percentage of credit card accounts carry a balance?

- What’s the average interest rate on people’s credit cards? What about those who carry a balance?

- How many Americans are currently delinquent with their credit card payments?

How much credit card debt do Americans have?

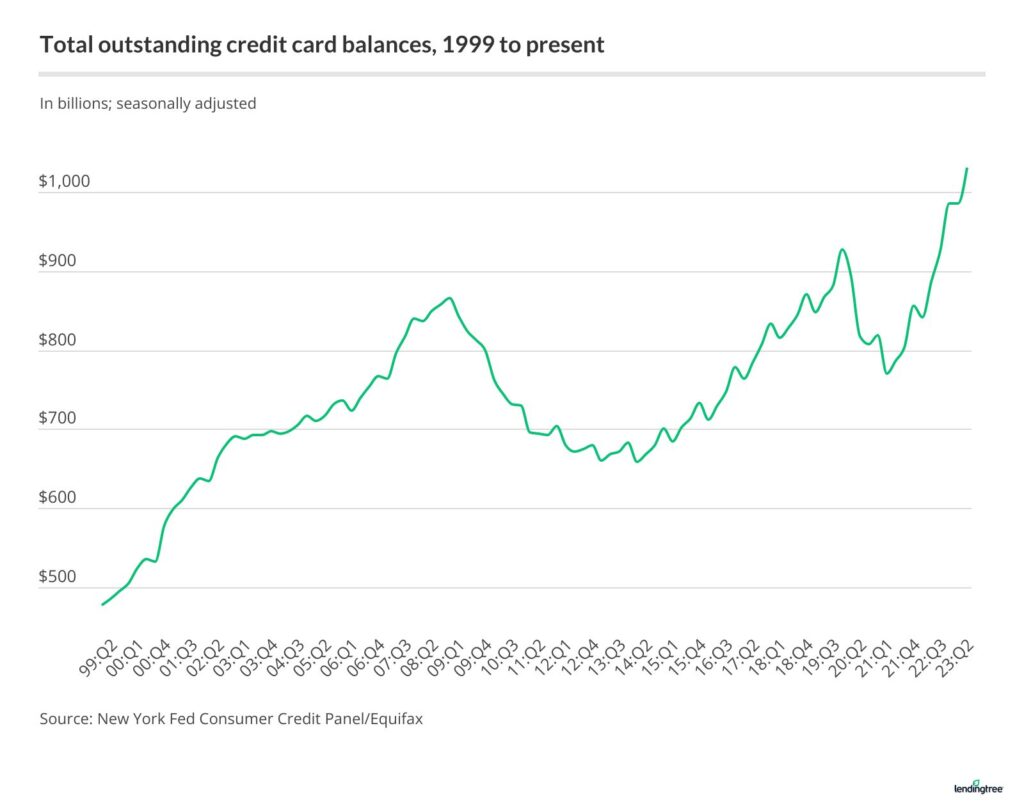

This is the first time credit card debt has topped $1 trillion in this country. The $45 billion second-quarter increase comes on the heels of a first quarter in which the credit card debt level remained unchanged. That lack of movement was noteworthy since it bucked decades-long historical trends, marking the first time since 2001 in which credit card debt didn’t fall in the first quarter. In fact, the only times card debt didn’t fall in the first quarter of the year since the New York Fed report began were 2000 and 2001. Every year since, card debt fell at least a little bit — until this year. That lack of a decrease may not bode well for Americans’ credit card debt numbers for the rest of the year.

With this latest increase, credit card balances have risen by $175 billion since the fourth quarter of 2021. Americans’ credit card debt is $104 billion higher than the record set in the fourth quarter of 2019, when balances stood at $927 billion. However, thanks to still-rising interest rates, stubborn inflation and myriad other economic factors, credit card balances are likely only going to climb, at least in the near future.

These record balances are light years above the $478 billion seen more than 20 years ago in the first quarter of 1999.

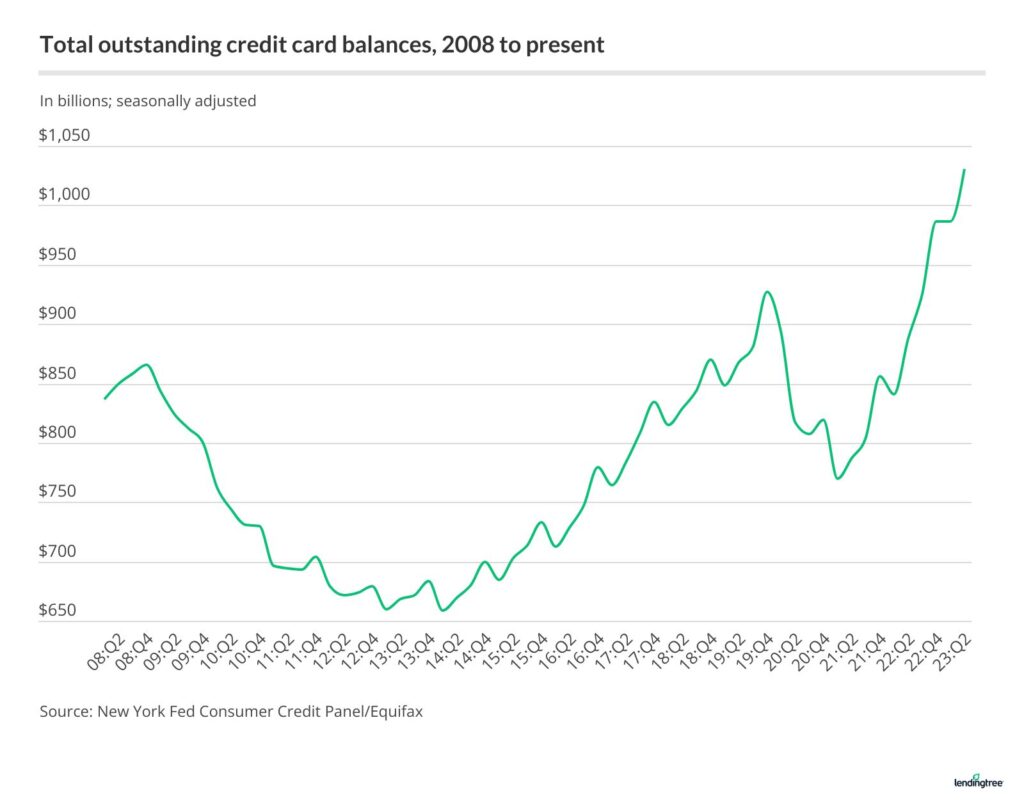

Card debt showed hockey-stick growth until the financial collapse in 2008, when balances fell from $866 billion in the fourth quarter of 2008 to $660 billion in the first quarter of 2013. But, as you can see in the chart below, the hockey stick returned.

Then, when the pandemic took hold in 2020, credit card balances plunged again — from $927 billion in the fourth quarter of 2019 to $770 billion in the first quarter of 2021. But — again — the hockey stick returned, thanks to a massive spike in the fourth quarter of 2021.

Which states’ residents have the most credit card debt?

Credit cardholders in Connecticut have the highest average credit card debt of any state, according to LendingTree data, while those in Kentucky have the lowest.

LendingTree analysts reviewed anonymized December 2022 credit report data from more than 370,000 LendingTree users to calculate these averages and create a list of states with the most debt.

The four states with the highest debt are in the Northeast, while three of the four with the lowest are in the South. There are major differences in the balances at the top and bottom of our rankings, with Connecticut cardholders owing $9,408 and Kentucky’s owing $5,408. That means the average Connecticut balance is 74.0% higher than the average balance in Kentucky.

In comparing anonymized December 2021 and December 2022 data, we found that 25 of the 50 states saw their average credit card debt grow by 10% or more. Two states’ average debt grew by more than 20% — Mississippi at 25.2% and North Dakota at 24.4%. Meanwhile, only Colorado (down 0.3%), California (down 1.7%) and Virginia (down 2.5%) saw their debt averages decrease.

What percentage of credit card accounts carry a balance?

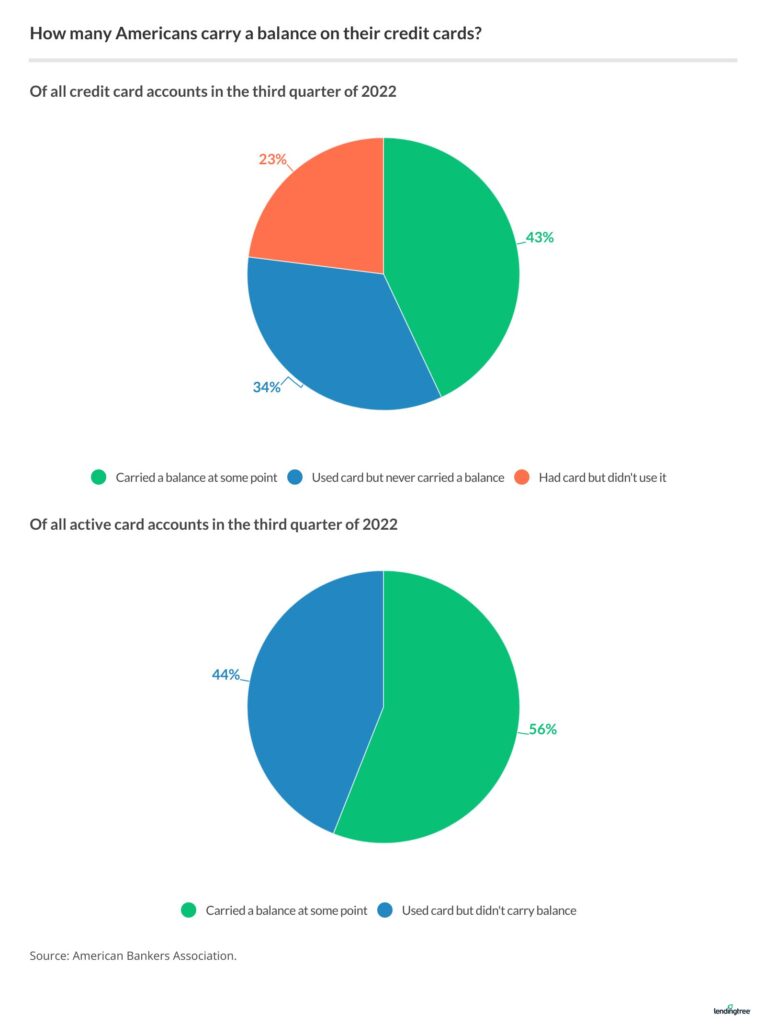

Americans carried a balance on 56% of all active credit card accounts in the third quarter of 2022, according to the most recent available data from the American Bankers Association.

Job No. 1 for anyone with a credit card is to pay off that balance in full at the end of each month. But we all know that life happens, and that means that it’s not always possible to pay off your credit cards each month.

American Bankers Association data showed that more than half (56%) of all active accounts carried a balance in the third quarter of 2022, the most recent quarter for which we have data. That’s up 3 percentage points from the second quarter of 2022. Even with the recent increases, however, that percentage is still below pre-pandemic levels. For example, 60% of active accounts carried a balance in the first quarter of 2019 before falling throughout 2020 to as low as 51% in the second quarter of 2021.

If you look at all credit card accounts, the American Bankers Association data shows that 43% of accounts were active and carried a balance at some point in the third quarter of 2022, 34% of accounts were active but didn’t carry a balance and 23% of accounts were dormant for the quarter.

What’s the average interest rate on people’s credit cards? What about those who carry a balance? What about new credit card offers?

For all credit cards, the average APR in the second quarter of 2023 was 20.68%.

For cards accruing interest, the average in the second quarter of 2023 was 22.16%.

For new credit card offers, the average today is 24.37% — the highest since we began tracking rates monthly in 2019.

| Average APRs for new credit card offers and current card accounts | |

| Average APR for new credit card offers | 24.37% |

| Average APR for all current card accounts | 20.68% |

| Average APR for all accounts that accrue interest | 22.16% |

Sources: LendingTree data, Federal Reserve

The Federal Reserve’s G.19 consumer credit report showed that the average APR for all current credit card accounts jumped to 20.68% in the second quarter of 2023, up from 20.09% in the first quarter. Meanwhile, APRs for cards accruing interest shot up to 22.16%, up from 20.92% in the first quarter. According to the Fed, the average for all card accounts and those accruing interest are the highest since tracking began in 1994.

And as the chart below shows, the rate you’re offered can also vary widely based on the type of card for which you apply.

Average interest rates on new credit card offers in the U.S. in August 2023

| Category | Minimum APR | Maximum APR | Average | Previous month |

|---|---|---|---|---|

| Average APR for all new card offers | 20.94% | 27.79% | 24.37% | 24.24% |

| 0% balance transfer cards | 18.65% | 27.59% | 23.12% | 22.99% |

| No-annual-fee cards | 20.38% | 27.52% | 23.95% | 23.80% |

| Rewards cards | 20.72% | 27.92% | 24.32% | 24.19% |

| Cash back cards | 20.78% | 27.46% | 24.12% | 24.04% |

| Travel rewards cards | 20.86% | 28.66% | 24.76% | 24.61% |

| Airline credit cards | 21.24% | 29.33% | 25.29% | 25.05% |

| Hotel credit cards | 21.65% | 29.42% | 25.53% | 25.34% |

| Low-interest credit cards | 13.84% | 22.97% | 18.40% | 18.11% |

| Grocery rewards cards | 20.50% | 28.08% | 24.29% | 24.12% |

| Gas rewards cards | 20.90% | 27.88% | 24.39% | 24.23% |

| Dining rewards cards | 20.60% | 28.34% | 24.47% | 24.34% |

| Student credit cards | 19.56% | 27.85% | 23.70% | 23.53% |

| Secured credit cards | 26.96% | 26.96% | 26.96% | 26.86% |

Source: LendingTree review of publicly available terms and conditions for about 200 U.S. credit cards

Of course, your best move is to make those interest rates a moot point by paying your card debt in full, but that’s often easier said than done.

How many Americans are currently delinquent with their credit card payments?

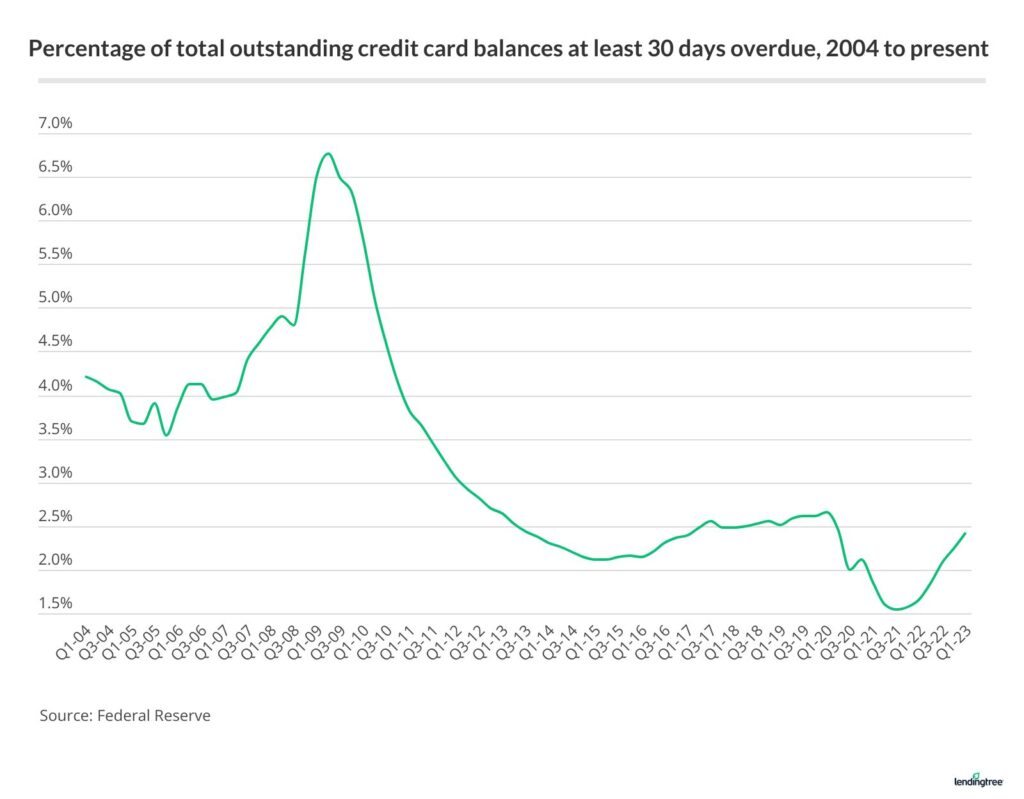

Just 2.43% of Americans’ total outstanding credit card balances are currently at least 30 days delinquent.

According to the most recent delinquency data from the Fed, the 30-day delinquency rate (or the percentage of total outstanding credit card balances currently at least 30 days overdue) rose from 2.25% to 2.43% in the first quarter of 2023.

That’s the sixth straight quarter of increases, keeping rates above 2% for the third straight quarter. However, delinquency rates are still near historic lows. Before falling below 2% in the third quarter of 2020, rates had never dropped below that number since tracking began in 1991.

It’s a huge difference from what we saw during the Great Recession, when delinquencies peaked at nearly 7% in 2009.