Personal Loan Statistics: 2023

According to the latest industry data, 22.5 million Americans owe a collective $222 billion in personal loans. That’s more than double the $102 billion owed in 2016, showing the growing popularity of personal loans.

The numbers behind the trends can reveal how borrowers are using personal loans — and how they impact consumers’ finances. Check out our personal loan statistics for a deeper look.

On this page

- Key facts

- Americans owe $222 billion in personal loan debt

- 22.5 million Americans have a personal loan

- Personal loan growth returns after dropping early in pandemic

- Personal loans account for about 1% of consumer debt

- More than 4% of personal loan accounts are 60 days or more past due

- Average balance on new personal loans passes $8,000 — and the APRs owed

- Consumers mostly borrow personal loans to pay down debt

- The bottom line: Expect personal loan debt to keep growing

- Sources

Key facts

- Americans owe $222 billion in personal loan debt as of the fourth quarter of 2022, up from $210 billion in the previous quarter and $167 billion a year earlier. That’s a 33% year-over-year jump and 6% from the previous quarter.

- 22.5 million Americans have a personal loan as of the fourth quarter of 2022, up from 19.9 at the end of 2021. The number of consumers with a personal loan has increased six quarters in a row.

- Personal loan debt makes up 1.3% of outstanding consumer debt in the fourth quarter of 2022. It accounts for 4.8% of non-housing consumer debt. To compare, Americans owe $990 billion in credit card debt, comprising 5.9% of outstanding debt.

- The delinquency rate (60 days or more past due) for personal loans is 4.14% as of the fourth quarter of 2022. That’s an increase from 3.00% a year ago.

- The average balance of a new personal loan is $8,018 as of the fourth quarter of 2022. A year ago, the average personal loan balance was $7,104.

- Most borrowers (55.7%) take out a personal loan to consolidate debt or refinance credit cards. The next-closest reason is home improvements (6.6%).

Americans owe $222 billion in personal loan debt

Personal loan borrowers owe $222 billion in debt as of the fourth quarter of 2022 — the highest in the 17 years for which data is available. That’s a substantial 33% increase from the fourth quarter of 2021, when Americans owed $167 billion.

Here’s an overview of the amounts Americans have owed on personal loans over time.

22.5 million Americans have a personal loan

As of the fourth quarter of 2022, 22.5 million Americans have a personal loan, up from 19.9 million in the fourth quarter of 2021.

The number of people with loans dropped during the pandemic from the previous height of 20.8 million at the end of 2019 to 18.7 million in the second quarter of 2021. Since, the number of personal loan borrowers has increased each quarter — six times in a row.

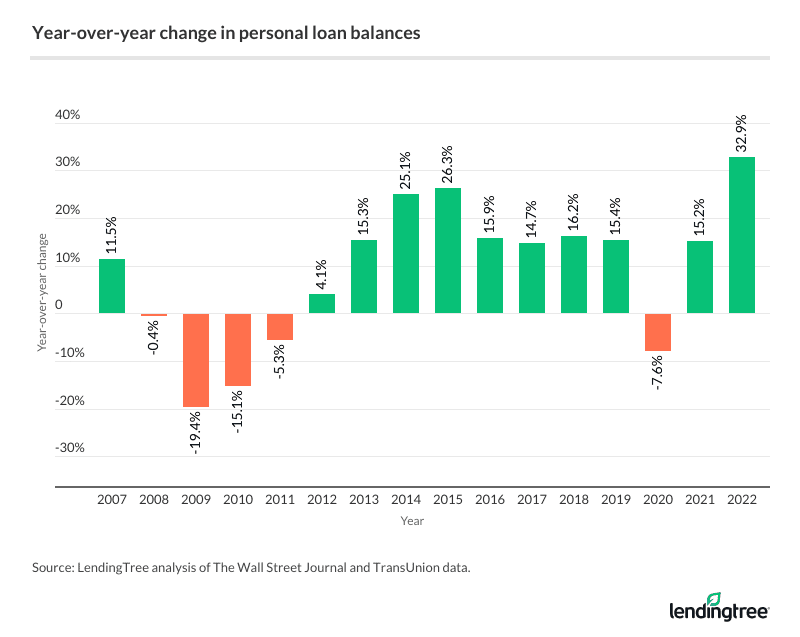

Personal loan growth returns after dropping early in pandemic

The massive, nearly-decade-long rise in personal loan debt ended in 2020, thanks to the pandemic. Personal loan balances fell 7.6% that year, marking the first decline since 2011.

But personal loan debt balances spiked 15.2% in 2021, reversing the previous year’s downward movement. Balances are up 5.7% in the fourth quarter of 2022 compared to the prior quarter and 32.9% since the end of 2021.

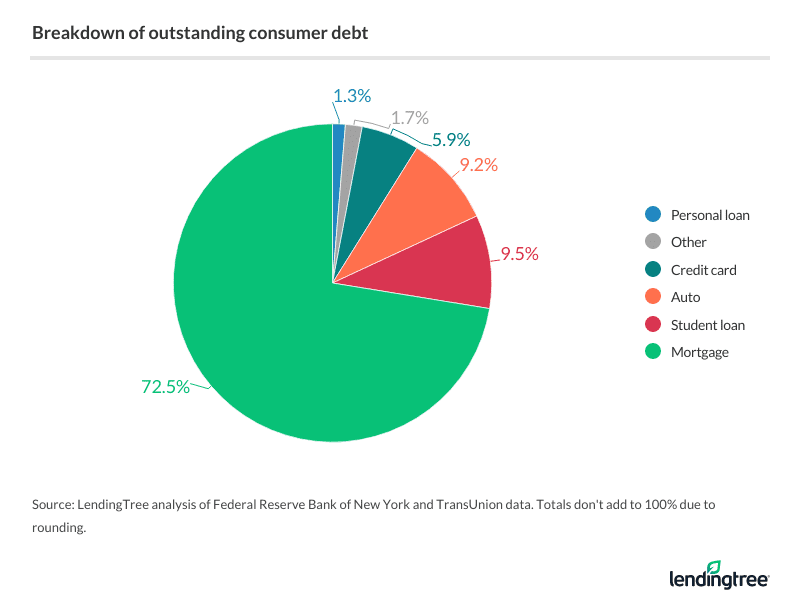

Personal loans account for about 1% of consumer debt

Personal loans continue to make up the smallest sliver — just over 1% — of consumer debt held by Americans despite the substantial growth over the past decade.

Comparatively, Americans owe $990 billion in credit card debt, comprising 5.9% of outstanding debt.

If you remove mortgages from the picture, personal loans account for 4.8% of non-housing debt.

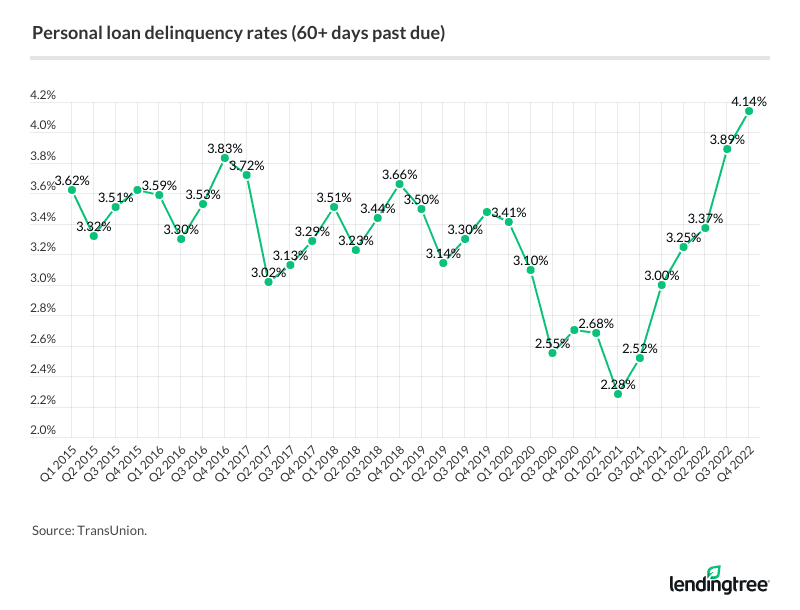

More than 4% of personal loan accounts are 60 days or more past due

An estimated 4.14% of personal loan accounts are 60 days or more past due as of the fourth quarter of 2022 — an increase from 3.00% as of the fourth quarter of 2021. That figure is significantly higher than rates for other common loan types, such as auto loans (1.78%), credit cards (2.26%) and mortgages (0.96%). (Note that credit card delinquencies are tracked at 90 or more days.)

Despite personal loan delinquency rates being high compared to other loan types, it’s interesting to compare today’s figures to the delinquency rate of 4.77% on consumer loans in 2009 when the Great Recession ended.

Average balance on new personal loans passes $8,000 — and the APRs owed

The average balance on new personal loans first crossed the $8,000 threshold in the second quarter of 2022 before coming back down a bit in the third quarter.

The average balance on new personal loans is $8,018 as of the fourth quarter of 2022, compared with:

- $7,104 in the fourth quarter of 2021

- $5,739 in the fourth quarter of 2020

- $6,211 in the fourth quarter of 2019

On average, borrowers with credit scores of 680 or higher see personal loan APRs competitive with the credit card APRs they would receive.

The average APR on new credit card offers is 23.84% as of April 2023, with average minimums and maximums between 20.19% and 27.10%. As the chart below shows, those with excellent credit who apply for a personal loan are getting a far better rate than that.

Personal loan statistics by borrower credit score

| Credit score range | Average APR | Average loan amount |

|---|---|---|

| 720+ | 14.34% | $19,657.52 |

| 680-719 | 21.19% | $16,032.83 |

| 660-679 | 32.30% | $12,392.46 |

| 640-659 | 44.50% | $10,010.65 |

| 620-639 | 62.90% | $6,881.93 |

| 580-619 | 89.86% | $4,811.89 |

| 560-579 | 125.18% | $3,147.46 |

| Less than 560 | 165.30% | $2,568.42 |

Source: LendingTree user data on closed personal loans for the first quarter of 2023.

However, subprime borrowers — who may not be eligible for other credit — generally have to pay far higher rates on their personal loans (if they even have loan offers extended to them).

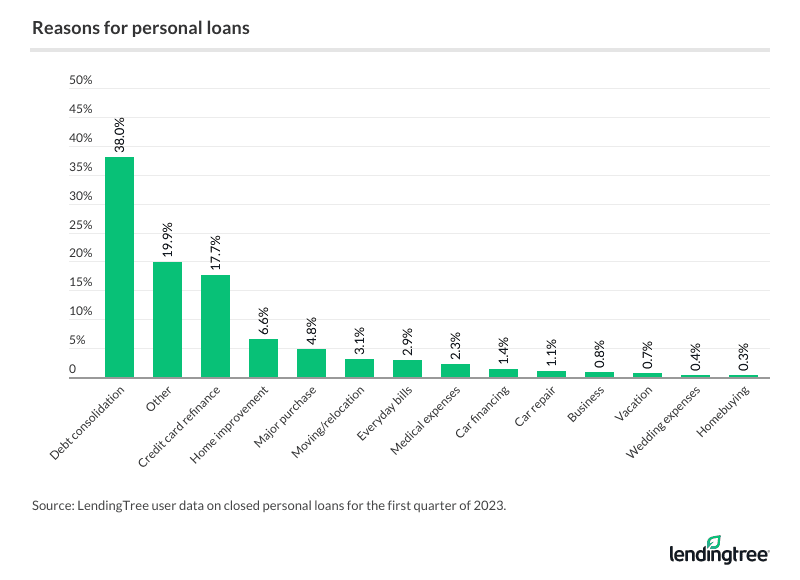

Consumers mostly borrow personal loans to pay down debt

More than half (55.7%) of LendingTree users seek personal loans to pay down debt, including 38.0% for debt consolidation and 17.7% for refinancing credit card debt.

The next most popular uses for a personal loan are paying for home improvements (6.6%) and funding major purchases (4.8%).

These personal loan statistics underline how important it is for borrowers to practice caution and wisdom when using this product.

Borrowers who use this product can come out ahead — but only if they weigh the decision, find a favorable personal loan and practice responsible debt management.

The bottom line: Expect personal loan debt to keep growing

Personal loan debt is growing rapidly, and that’s unlikely to change anytime soon. That’s because credit card debt is rising, too, and will likely continue to do so for the foreseeable future.

When that happens, people look to personal loans to help them get their credit card debt under control, and it can be a great tool for that. If you have really good credit, a 0% balance transfer credit card might be a better choice for consolidating and refinancing other debts. Still, a personal loan can also be a strong option.

Still, it’s important to understand that people don’t only take out personal loans when they’re struggling. Many use them when remodeling their home, starting a business, planning a wedding or vacation and making other big purchases. They do it because they feel comfortable enough about their financial situation to take on a little bit of short-term debt. That’s likely the situation for millions of Americans today, and those folks will help drive consumer demand for personal loans higher as well.

Add all this up, and it’s highly likely personal loan growth is going to continue in the coming months. Many folks will struggle with managing those loans, especially if economic conditions worsen. However, those who handle these loans well — especially those who use them to knock down their overall debt — can make a real difference in their financial situation, and that’s a big deal.

Sources

- TransUnion

- The Wall Street Journal

- Federal Reserve Bank of New York

- LendingTree